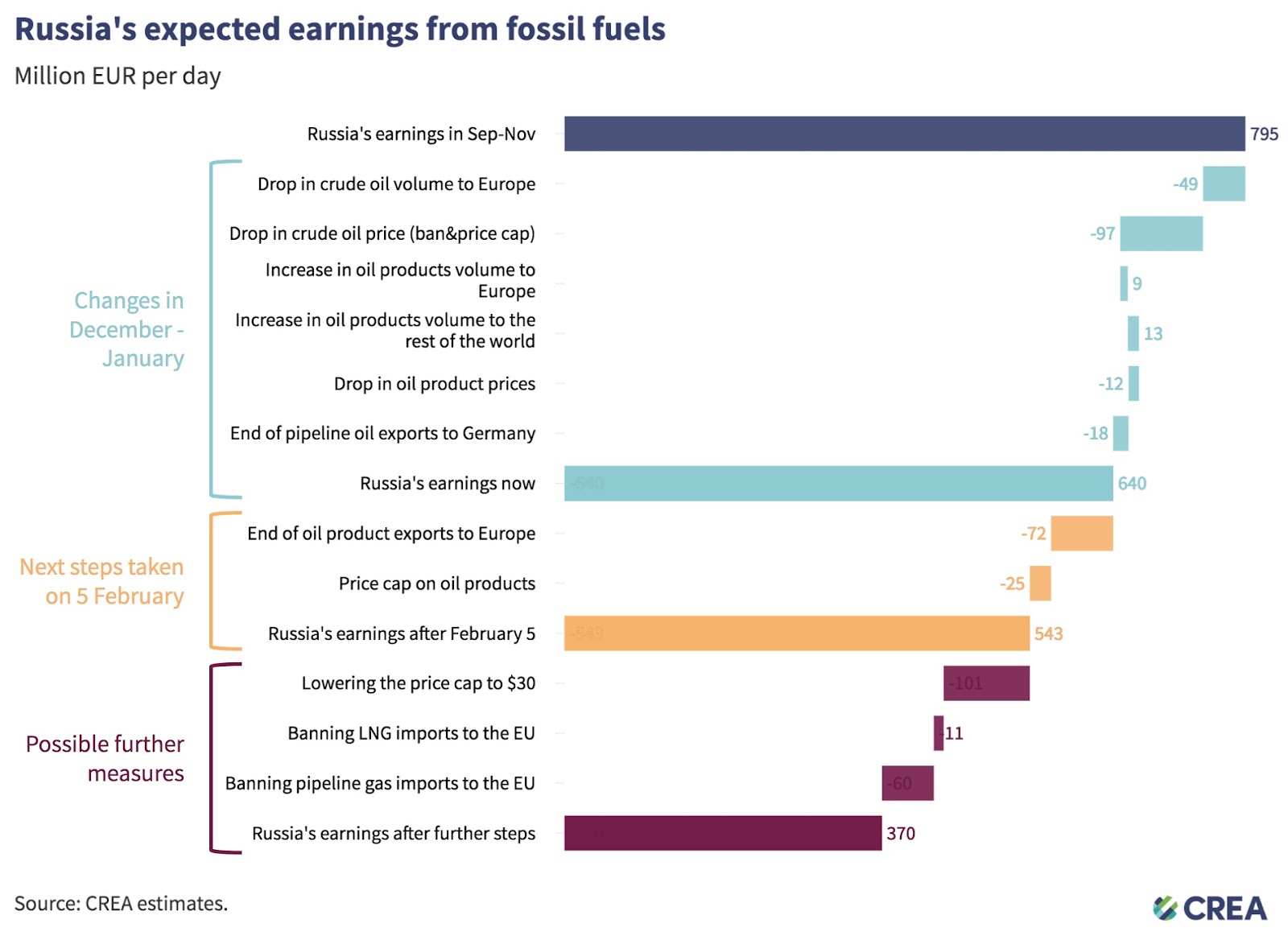

HELSINKI, 11 January 2023 — The EU ban on crude oil imports from Russia and the oil price cap are costing Russia an estimated EUR 160 mn/day, expected to rise to EUR 280 mn per day with additional measures that are being implemented by 5 February. In assessing the impact of the EU ban on Russian seaborne oil that came into effect on 5 December 2022, the findings from the Centre for Research on Energy and Clean Air (CREA) reveal that Russia’s earnings from fossil fuel exports have fallen significantly, largely due to the ban.

The EU ban on Russian oil was an extraordinary step taken to axe the funds from Europe financing Putin’s war.

In December 2022, Russia’s earnings fell 17%, to the lowest level since the start of the country’s invasion of Ukraine. The EU’s crude oil import ban and the wider price cap caused a 12% reduction in Russia’s crude oil exports and a 23% drop in selling prices, for a 32% drop in Russian crude oil revenues in December. In addition to those measures, at the end of December, Germany stopped pipeline oil imports, which caused a further reduction of 5%.

Despite the drop in income, Russia’s fossil fuel exports are still earning them EUR 640 million per day, set to fall to approximately EUR 520 million by February, as the EU ban on refined oil imports and the extension of the price cap to refined oil come into effect. CREA identifies further steps that can cut Russia’s revenue by a further EUR 200 million per day.

“The EU’s oil ban and the oil price cap have finally kicked in and the impact is as significant as expected. This shows that we have the tools to help Ukraine prevail against Russia’s aggression. It’s essential to lower the price cap to a level that denies taxable oil profits to the Kremlin, and to restrict the remaining oil and gas imports from Russia”, said Lauri Myllyvirta, Lead Analyst at the Centre for Research on Energy and Clean Air (CREA).

Under the current price cap, Russia has so far made EUR 3.1 billion in shipping crude oil on vessels covered by the price cap. The tax income going straight to the Russian government comes to approximately EUR 2.0 billion. This tax income can be eliminated almost completely by revising the price cap to a level that is much closer to Russia’s costs of production.

The price cap was initially set at USD 60 per barrel, far above Russia’s costs of production, to avoid any disruption to oil supply. Lowering the crude oil price cap to USD 25–35, still well above production and transport costs in Russia, would slash Russia’s oil export revenue by at least EUR 100 million per day.

The EU remained the largest importer of oil from Russia in December, including pipeline crude oil and all oil products. This will have changed as Germany ceased to import Russian pipeline oil at the end of December and the EU oil products ban enters into force in February. In addition to these measures, a price cap revised down would effectively tighten the EU’s purse strings and further choke off Russia’s funding for the war.

“The first month of embargo proves what we’ve been saying from the beginning of the invasion: income from exports of fossil fuels is the financial bloodline for Putin’s war. The EU and G7 have the power and all means to cut this bloodline. Only force and money speak to the Kremlin. The price cap needs to be revised down and enforcement of the embargo should be strengthened. Without fossil fuel export income, Russia’s brutal onslaught on international law, human rights and the environment will collapse. We need more action from the price cap coalition — not only lowering the price cap, but also introducing additional sanctions to close loopholes,” said Svitlana Romanko, Founder and Director of Razom We Stand.

In the Pacific, Russia continues to use UK-insured tankers to sell oil to China, although the market price for the oil is above the price cap level.

- In light of the increasing urgency of disabling Russia from funding their war, the Centre for Research on Energy and Clean Air (CREA) proposes the following policy recommendations:

- Make reductions in fossil fuel demand more sustainable economically and socially by further investing in energy efficiency, energy savings and clean energy as these reductions have enabled the implementation and effectiveness of the import bans.

- Revise the oil price cap down to USD 25–35 per barrel of crude oil and USD 5/barrel higher for refined products. This level substantially reduces Russian mineral tax revenues while keeping Russian oil production economically viable.

- Strengthen the implementation of the price cap by increasing penalties for tankers violating the cap, as well as strengthening disclosure requirements or requiring payments to be made through an intermediary.

- Introduce additional sanctions to limit Russian seaborne oil trade. This includes restrictions on sales of tankers, to prevent Russia, its allies and related traders from acquiring old tankers to use to circumvent the cap, as well as prohibiting transhipment of Russian oil in territorial waters and exclusive economic zones of price cap coalition countries. Restrict the use of tankers without adequate insurance coverage and ensure the enforcement of environmental norms for tankers in the Baltic and Black Seas.

- Institute price caps and/or import restrictions for pipeline oil, pipeline gas and LNG from Russia to the EU.

Contacts:

Lauri Myllyvirta

Lead Analyst, Centre for Research on Energy and Clean Air (CREA)

lauri@energyandcleanair.org

Oleg Savystskyi

Campaigns Manager, Razom We Stand

oleh@razomwestand.org

Notes to editors

The full briefing related to this press release is available here.

All CREA publications can be found here.

About the data

To carry out the research, CREA researchers compiled data on the movements of thousands of cargo ships carrying fossil fuels and other cargo from Russian ports to the rest of the world, to track shipment destinations and volumes on a day-to-day basis. The tracking covers ship-to-ship transfers to the extent possible. The research also incorporates real-time data on gas flows to Europe via pipelines, and estimates other flows using historical monthly trade data and news reporting. To estimate the value of the imports, CREA developed pricing models that estimate the average value of Russian exports based on current spot market prices. The methodology is laid out in more detail on the CREA website:

https://energyandcleanair.org/financing-putins-war/methodology/